We left off with my last post discussing why I first decided to join Enformion. In short, I truly believe in Enformion’s unique data and they can help “underserved” populations with identity verification. I also strongly believe in Enformion’s products and solutions when it comes to business verification.

Small businesses (defined as a business with less than 500 people) represent approximately 99.9% of all companies (SBA 2022). Verifying the legitimacy of those businesses, the ultimate beneficial owners (UBOs), officers, and shareholders is a vital component of everyday life.

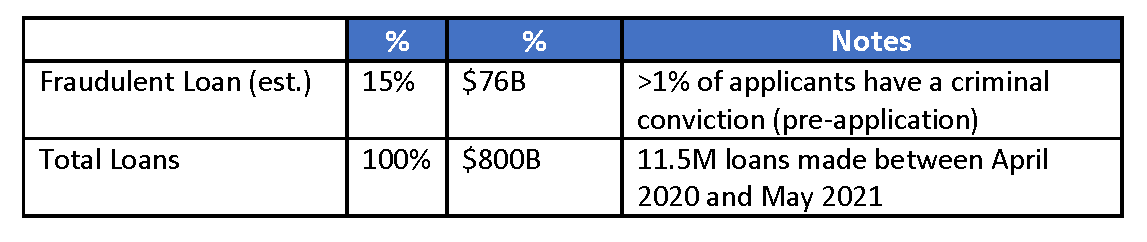

The Paycheck Protection Program (PPP) is the most significant, recent case study for the market need to verify businesses (more here):

All of my fraud-fighting buddies know it is a lot easier to retire rich as a fraudster by targeting businesses instead of targeting consumers. Not only do they have more assets to steal, but there are also fewer solutions in the market to help authenticate businesses and to prevent fraud.

Also, it is a lot easier to launder money and hide assets using a corporation and or trust structure. Whether it is for compliance or fraud prevention purposes, companies need reliable business insights in an automated format. Fighting the bad guys should make it easier for the good guys to start, fund and operate small businesses.

My role at Enformion is to build those solutions. In so doing, I hope that more of the “underserved” populations will gain access to credit, particularly small business loans, to live out their American Dream.

Keep an eye out for my next post which will go into further detail about how and what I’ll be doing at Enformion to help drive that vision. And a special offer to those interested in experiencing Enformion’s solution first-hand!

—Garient Evans, SVP of B2B Products