It is all too easy for many organizations and even some individuals to define a person by their credit score and file. This record of personally identifiable information has taken over as a measure of a consumer’s identity and creditworthiness. The problem is these reports can be severely lacking in detail and may not tell the whole story. This is where alternative data comes into play.

A significant portion of the population falls into the category of the “underbanked” or “credit invisible.” According to a report by the Consumer Financial Protection Bureau (CFPB), approximately 26 million Americans are considered credit invisible, meaning they have no credit history with any of the three major credit bureaus. Another 19 million Americans are considered “unscored,” which means they have a limited credit history that prevents them from being assigned a credit score. In addition to the limitations of using credit scores to measure creditworthiness, credit header data is also problematic for identity verification.

This lack of identity visibility can make it difficult for consumers to access products and services and can lead to them being denied loans or benefits and being charged higher interest rates. Alternative identity data can play a critical role in expanding access to services for these underbanked and credit-invisible individuals. By looking beyond traditional sources of identity data such as credit reports, and considering alternative sources of identity information, businesses can gain a more comprehensive understanding of an individual’s identity and make more informed decisions.

What is Alternative Identity Data:

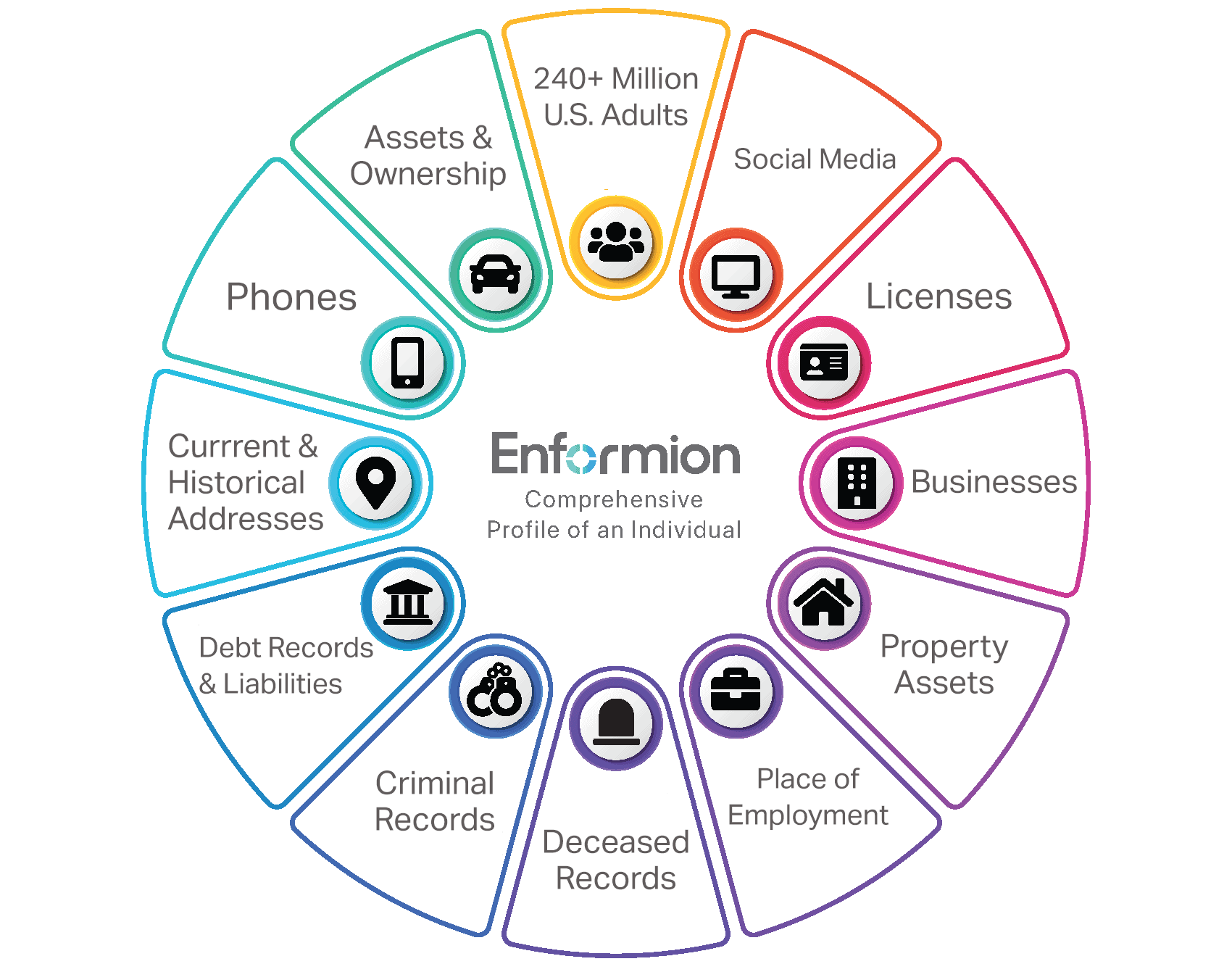

Alternative identity data refers to non-traditional information sources that can be used by organizations to determine who an individual really is. This data can include employment & education history, criminal & legal history, associations to properties and assets, social media and phone records, as well as other data points that may not be captured by traditional identity sources. The use of alternative data is intended to provide a more complete picture of an individual’s identity, which can help organizations make more informed decisions about doing business with these consumers. Alternative data has become increasingly important as a means to open up markets to those who might have been overlooked or underserved in the past.

Accessing a Broader Market

Alternative identity data is still underutilized by many institutions that are stuck in an old model of doing business. They haven’t caught on to the advantages that alternative data can provide. Here’s how Forbes.com described this frustrating situation:

Slow adoption of alternative credit in the lending process has not been due to a lack of proof of its value or even consumer willingness to share such information. 70% of Americans say they would share more personal data if it would lead to fairer credit decisions.

Even though many Americans say they are more than happy to share personal data to obtain more equitable service, it is not yet happening on a wide scale. That said, in the places where it is being adopted, it’s engendering both happier consumers and more profitable businesses. By providing both sides of the transaction with additional clarity that they simply did not have before, organizations can capture a broader segment of the market that they may have overlooked.

Weeding Out the Truly Undeserving Consumers

Alternative Identity data is often heralded for its ability to open up markets to those who might have been underserved in the past. On the other hand, it can also protect organizations from consumers who represent true risk. For example, FICO scores are currently at some of their highest averages ever recorded. This makes it more difficult to determine who is deserving of credit, who may have simply benefited from economic conditions, and what an individual’s propensity to pay is.

The increase in identity theft and synthetic identity fraud also poses a significant challenge for businesses. Synthetic identity fraud losses are projected to surpass $2.42 billion in 2023, underscoring the importance of identity data in identifying and preventing these fraudulent activities. Criminals are employing more advanced techniques, making it challenging for traditional data sources to detect and thwart fraudulent behavior. These risks are also driving the increased use of alternative identity data across the market.

Alternative Attributes for Identity Assessment

Other attributes can be used for assessing a person’s identity beyond what is available in traditional credit files. These alternative attributes are valuable sources of intelligence, not only because they offer new data endpoints-points, but even more so because of the predictive scores and analytics that can be built from them. These provide organizations with the insights needed to make more informed decisions.

Understanding an individual’s connections to other people, properties, businesses, and assets adds an additional layer of intelligence, this context is an important part of how alternative data can help clarify the full picture of a person’s identity and risk profile. Insights can be gleaned by mapping these relationships. New metrics such as household composition, address confidence, and propensity to pay are among the many scores that are being modeled by linking these entities.

A person’s associated property history, through ownership or places where they have physically lived, provides a great deal of intelligence that can be used for a variety of purposes, including verifying if a person is who they say they are. Likewise, a person’s connections to businesses and assets such as motor vehicles can aid in assessing someone’s creditworthiness, or eligibility for government benefits.

Criminal and legal history can also be useful sources of information about an individual’s trustworthiness and overall risk. Another attribute, education history, can indicate a person’s level of financial literacy and ability to manage money. An individual’s employment history can provide insight into their stability and ability to generate a steady income.

Social media activity is also a source of alternative data that is increasingly being used. Social media activity can provide insight into an individual’s lifestyle, interests, and connections, all of which can help businesses better understand their consumers’ behavior and potential risk. However, it is important to note that there are significant privacy concerns around the use of social media data, and regulators are still grappling with how to address these concerns.

Overall, the use of alternative data sources is a rapidly growing trend across many industries. By incorporating these additional sources of data into their decision-making processes, organizations are gaining a more comprehensive understanding of their consumers.

Phone-Based Identity Information as an Alternative Data Source

Another important type of alternative identity data that is gaining traction is phone-based identity information. With the widespread use of mobile phones, many businesses are looking at phone-based data as a source of information to verify an individual’s identity and assess their risk.

Phone-based identity verification involves using an individual’s phone number to resolve identity information about them from public records and other sources. This information can then be used to verify their identity and assess their risk. For example, phone-based IDV can be used to verify an individual’s name, address, and other demographics. It can also be used to check for criminal history, liens, judgments, and other alternative data assets that help evaluate the consumers’ riskiness. This case study highlights the potential of phone-based IDV.

As phone-based IDV continues to gain popularity, more organizations will likely incorporate this type of alternative data into their processes. Phone-based IDV has the potential to expand access to products and services for underbanked and credit-invisible individuals, while also helping businesses make more informed decisions.

The Future of Alternative Data

Although alternative data has gotten a foothold as an accepted concept for many organizations, it is anticipated that it won’t be long before these types of data are preferred over outdated traditional methods. In fact, many believe that the number of factors that can be measured in the data profile of any individual is so vast that consumer decisions going forward can only continue to get smarter and much more targeted. It just makes sense that organizations would like to tap into as much information as they can when engaging with a consumer.

Choosing an Effective Data & Analytics Solution

Selecting an appropriate data and analytics solution for identity verification is crucial to ensure profitability, preserve reputation, and comply with legal regulations. Enformion offers identity verification and fraud mitigation solutions with advanced analytical capabilities and a comprehensive view of over 280 million consumers. Our range of products empowers businesses to make more informed decisions. Contact us to learn more or request a customized demo.