Thin Files & The Underserved: Opportunities, Challenges, and Solutions

When working in the world of big data, there’s a term that often comes up—thin files. Thin files refer to datasets that are incomplete or contain limited information about a particular subject. These files can be a challenge to work with, but they hold a wealth of potential for various industries. It’s important to know what thin files are, who typically has them, why they matter, and how professional services can help optimize the usage of thin file data.

What Are Thin Files?

Thin files refer to records or data profiles that lack comprehensive information, essentially data records with insufficient or incomplete information. These files provide only a limited view of an individual’s history. This often occurs due to various factors, such as age, financial history, residency, or a lack of engagement with traditional credit services.

In general, thin files can be categorized into various types, but one common thin file pertains to contact information. For instance, a contact thin file might have an email address and a phone number, but it’s missing other details such as a physical address or social media accounts. These data records lack the comprehensive information typically found in more complete profiles, and would often be overlooked because of that.

Who has Thin Files?

Thin files are typically associated with individuals who have little to no known credit history. This might be due to their age, financial history, residency status, or a variety of other factors. Additionally, individuals who are part of underserved communities may have thin files due to a lack of available financial services. These files are like incomplete pages in the digital book of a person’s financial identity, only providing minimal information about an individual, which presents both challenges and opportunities. These individuals have been seen by credit bureaus very few times and often have no recent activity, making it difficult to be confident in accurate contact information. Files that lack information could also be related to new users, individuals with privacy concerns, and those who have infrequent online engagement.

Who Are The Underserved?

“The Underserved” pertains to individuals in the United States who may be young, immigrants, or not actively participating in the traditional financial system. It’s estimated that 19.4 million Americans, about 8.3 percent of the U.S. adult population, have credit records that cannot be scored, while an additional 26 million Americans are considered credit invisible. (CFPB)

These individuals possess substantial economic potential and deserve fair and equal access to a variety of products and services. Enformion has solutions to streamline the verification process of these “underserved” groups enabling businesses to provide them with loans, opening deposit accounts, conducting money transfers, and accessing government benefits.

Why is Thin File Data Important?

Thin files are a valuable resource with the potential to drive significant benefits for companies. They serve as a doorway to untapped markets and the development of innovative solutions. There are several compelling reasons why thin file data holds immense importance:

Thin files contain information on individuals who often lack access to traditional services. By gaining insights into the behaviors of these individuals, companies can tailor their products and services to cater to their specific needs, thereby identifying new and potentially lucrative market opportunities.

Thin files can also be used to help reduce the risks of fraud. Characterized by a limited credit history or sparse data records, thin files can pose challenges in discerning between accurate and fraudulent information. The scarcity of data in thin files may make them susceptible to manipulation or misrepresentation, potentially masking fraudulent activities. It becomes crucial for businesses to employ robust tools and strategies that can effectively differentiate between legitimate records and those indicative of fraudulent behavior. The ability to navigate and interpret thin files accurately not only safeguards against potential fraud but also ensures that businesses make informed decisions based on reliable data, contributing to overall risk mitigation and operational integrity.

Completing missing thin file data can also provide a unique window into customer behaviors and preferences. This valuable information can be harnessed to create personalized marketing campaigns that significantly improve customer engagement and retention, enhancing the overall customer experience.

Above all, thin file data is a goldmine of opportunities, from uncovering untapped markets to mitigating risk and optimizing customer engagement, it holds the potential to transform how companies approach their operations and strategy. This makes it an indispensable resource in the data-driven business landscape.

Thin File Usage and Reaching The Underserved

We’ve established why thin files are important and highlighted their usefulness for companies looking to use customer data to boost business operations. However, how does this translate to the real world, and how do those using thin files feel about the reasons and challenges behind reaching underserved communities?

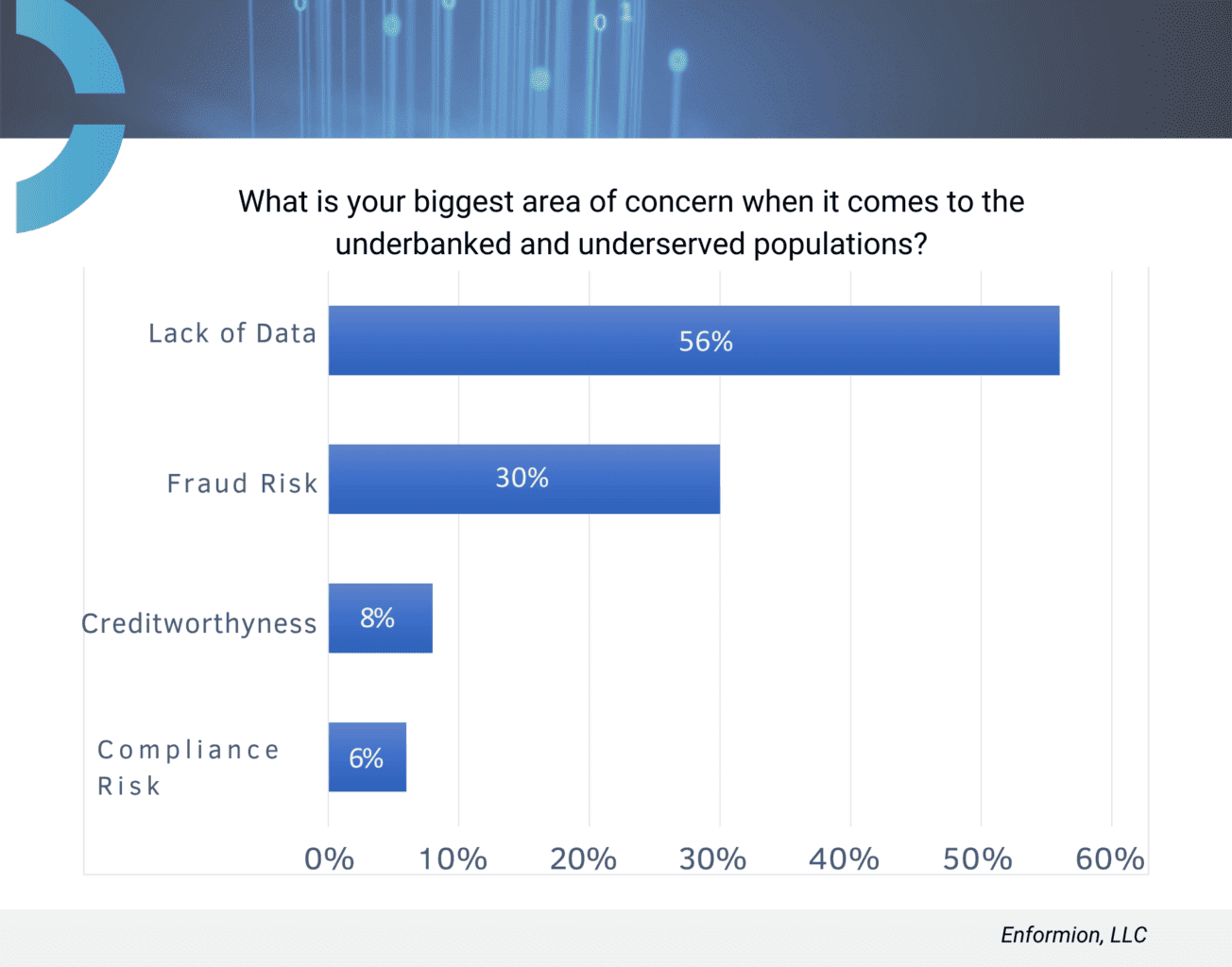

Enformion recently covered these topics and asked users to share their opinions about thin files usage and reaching the underserved. Results showed that 56% of participants shared a common concern regarding the general lack of data associated with these populations. Thin files hold a wealth of knowledge about potential target audiences and customer bases, and this concern for scarce information may be holding some organizations back when it comes to getting the most out of their data.

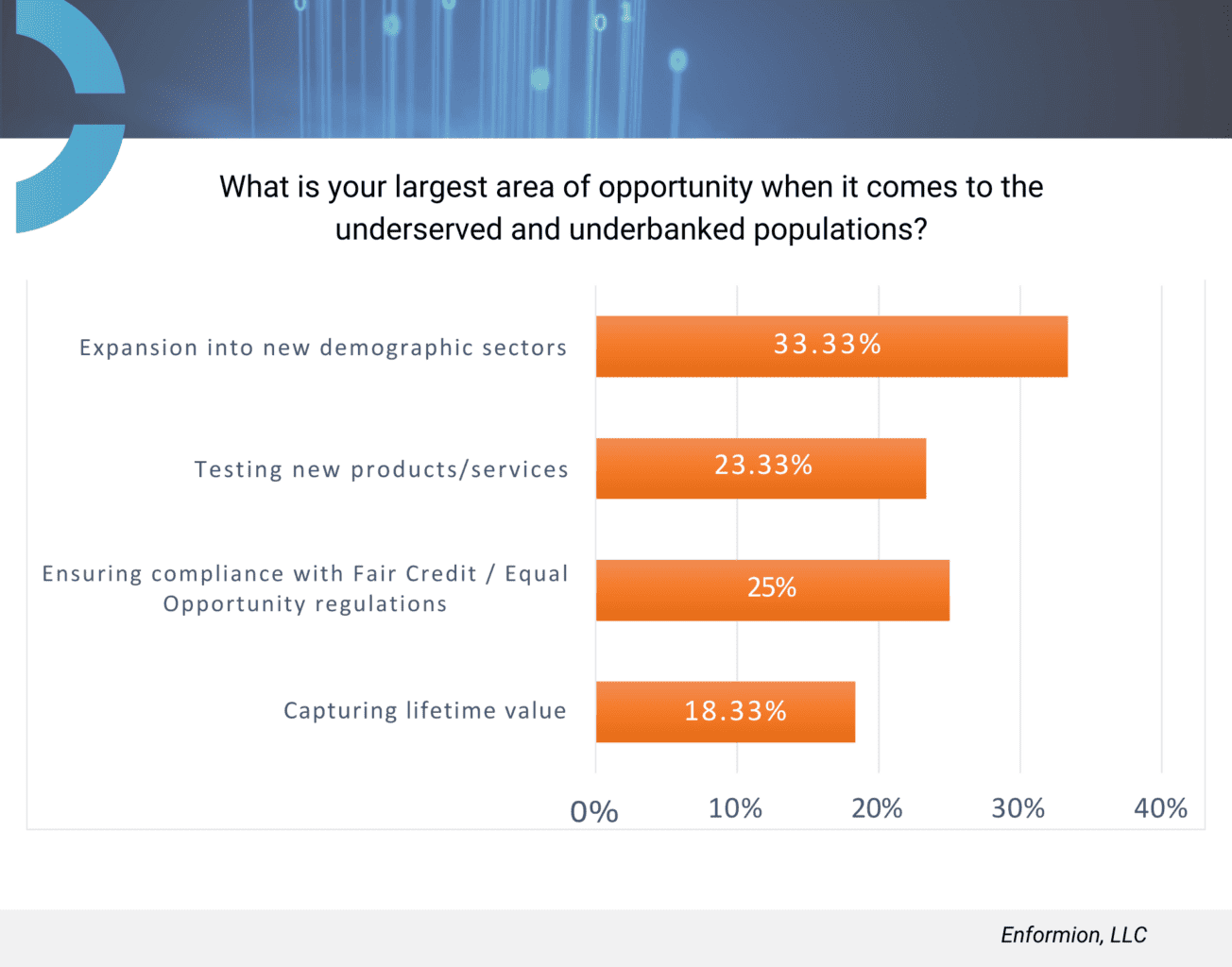

This same user base was also asked about where they saw the largest area of opportunity when regarding this population. Over half of those asked were interested in either “expansion into new demographics” or “ensuring compliance with fair credit / equal opportunity regulation”. Clearly, businesses are interested in seeing the potential behind incomplete files and unlocking new demographics to target. We also see the relevance for businesses in completing thin files for compliance purposes. The more you can discover about individuals in your database, the better equipped you are to handle compliance issues and keep up with regulation standards.

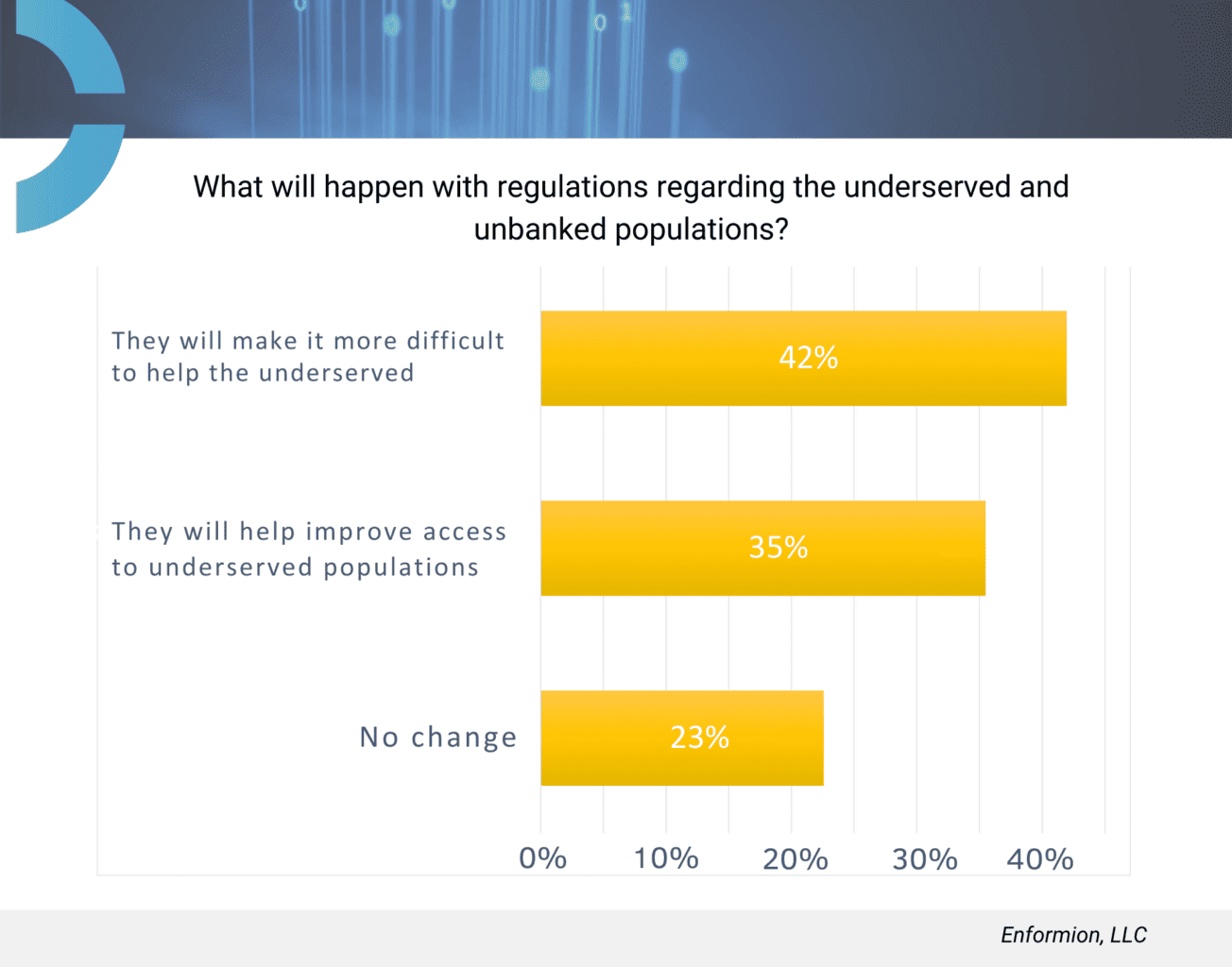

Enformion also asked participants how they predicted regulations would affect their ability to engage with underserved or underbanked communities. The most common answer, with 42% in agreement, was that regulations would make it more difficult to help those in underserved communities. They believe current and future regulations will hinder efforts toward establishing credit and building stronger data for identity authentication.

Seeing how industries view thin file data, their usefulness, and the impact it makes on underserved communities helps us understand its importance in the field of data management. Communities with little known information are easy to overlook and often disregard, this mistake leads to businesses turning a blind eye to identification assistance, easier regulation compliance, and reaching potential new markets.

Optimizing Thin File Usage

The key to unlocking thin file data lies in the hands of professional data services with access to big data and the technology to accurately analyze available information. These services can turn incomplete and sparse data into substantial and valuable customer information through a range of strategic approaches.

Identity Verification: For businesses, ensuring the authenticity of customer identities is not just a convenience but a critical requirement. Professional data services play a pivotal role in this aspect by helping verify the identities of individuals with thin files. This, in turn, aids in mitigating fraud risks and maintaining the trust of both businesses and customers.

Data Enrichment: One of the core capabilities of professional data services is data enrichment. These services amalgamate data from a variety of sources, encompassing public records, social media, and proprietary databases, to create comprehensive customer profiles. This process effectively bridges the gaps in thin file data, transforming it into a valuable resource, rich in insights.

Custom Solutions: Recognizing that each business and industry has unique needs, data services offer customized solutions to address specific goals. Whether a company operates in finance, retail, or any other sector, these tailored solutions empower businesses to harness thin file data effectively. This adaptability ensures that thin file data is leveraged in a manner that aligns with the company’s specific objectives.

Overall, professional data services are a great resource for converting thin file data from an underutilized asset into a powerhouse of insights and opportunities. Expertise in data enrichment, identity verification, and tailored solutions is the catalyst for any businesses seeking to make the most of this often under-estimated resource.

Final Thoughts

In a world where data drives success, thin files should not be overlooked. They are a hidden treasure trove of information that can help businesses reach new markets and make better decisions. For those looking to take advantage of their thin files, there are ways to unlock this information through the help of professional solutions. Don’t miss out on the opportunities that thin files can offer – transform incomplete data into valuable assets for your business.

Discover how Enformion utilizes thin file data and learn more about how these solutions can work for you.